EPF FORM 15G AND 15H DOWNLOAD

However, as per current Government rules and regulations, deductor is supposed to retain Form 15G for a period of seven years. Form 15G can be submitted as the total tax liability for the year is nil and aggregate interest income for the year is less than basic exemption limit. I just downloaded the latest form from the site. Upon verification, Income Tax Department will process your refund claim request and credit the excess tax deducted for the financial year. However, you must fulfil conditions listed above to apply for these forms, i. Thank you for writing.

| Uploader: | Mujar |

| Date Added: | 19 May 2013 |

| File Size: | 14.59 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 40443 |

| Price: | Free* [*Free Regsitration Required] |

Do remember that under Field 16 of Form 15G, mention the estimated income for which you are filing the Form.

Form 15H can be submitted although interest income exceeds basic from limit. Elf 15H can be submitted if age is more than 60 years and tax calculated on total income is nil. When your service is less than 5 years and you are ans the EPF, then during the financial year of your withdrawal, it is taxed under your head. It is better to submit Form 15G as soon as possible to avoid any additional deductions for the current fiscal.

Even if you worked in multiple organizations but you retained the same EPF account, then such combined service period is considered as single and eligible for TDS exemption if your combined all earlier employments contributory period is more than 5 years. Updated on Fodm 17, - In this article, we cover the following. TDS deduction is applicble or not? Do remember that you have to fill Part 1 of the Form 15G and no need to fill Part 2. Thanks a lot for explaining the process in such a good detail.

This includes only Employee and Employer contribution. Learn how your comment data is processed. You can also subscribe without commenting.

Notify me of followup comments via e-mail. Form 15G can be submitted as age is less than 60 years.

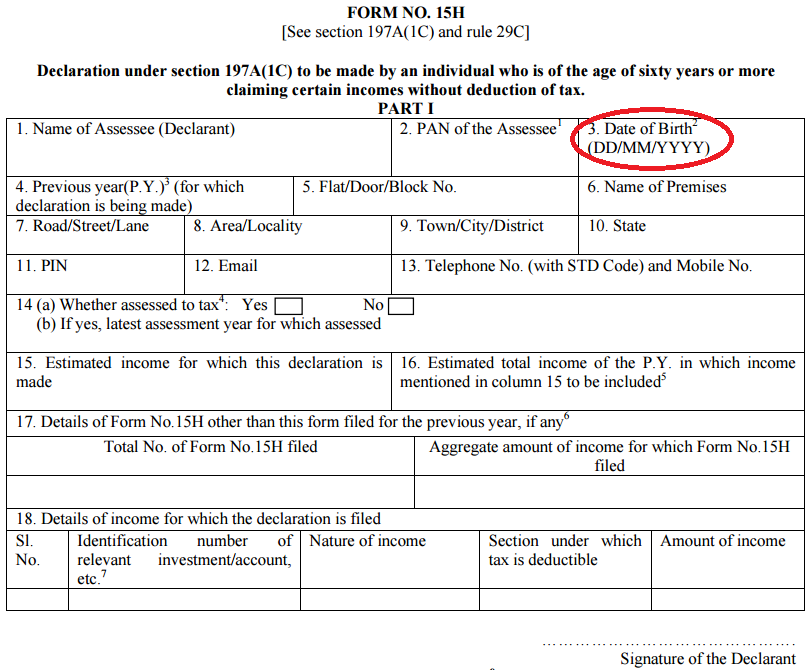

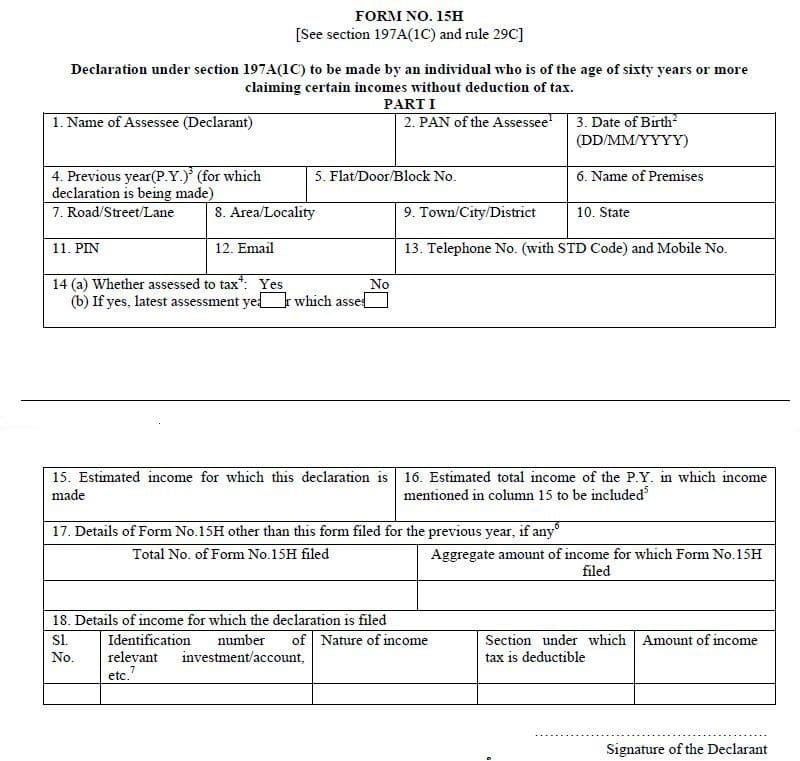

Forms 15G and 15H to save TDS on Interest Income

No harm in submitting the Form 15G. Home Taxes in India Form 15G: Most banks in India now provide the option of filling out and submitting Form 15G online. Below are certain eligibility conditions to be followed before submitting the Form 15G or Form 15H.

epr The purpose of this blog is to "Spread personal finance awareness and make them to take informed financial decisions. Should in submit 15G form to avoid TDS deduction. Start your Tax Return Now.

Submit Form 15G for EPF Withdrawal online, TDS, Sample Filled Form 15G

One should keep in mind that self-declaration using Form 15G holds good only for that particular financial year. Upon verification, Income Tax Department will process your refund claim request and credit the excess tax deducted for the xnd year.

These can only be submitted by resident Indians. The final tax on his estimated total income computed as per the provisions of the Income Tax Act should be nil.

Tax Saving Investments Made Simple. I just downloaded the latest form from the site.

EPF Form 15G - How to fill online for EPF withdrawal? - BasuNivesh

You should submit this form only if tax on your total income is zero 1h with other conditions. Form 15G cannot be submitted since aggregate interest income for the year is more than basic exemption limit. Form 15G for reduction in TDS burden can be downloaded for free from the website of all major banks in India.

If you meet these requirements then you can withdraw online. Form 15G is for those whose age is below 60 years of age.

Hii Dear You have not required for form 15G.

Комментарии

Отправить комментарий